Building Strategic Real Estate Portfolios for Corporations

Corporate executives are under increasing pressure to optimize every asset on the balance sheet—including real estate. For firms with storage needs, industrial activity, or office footprints, real estate can either be a burden or a powerful tool for growth and liquidity. That’s where Real Estate Partners come in. By working closely with executives to carefully select and develop high-value sites, these experts help companies build real estate portfolios that do more than house operations—they create strategic leverage.

The Real Estate Imperative in Corporate Strategy

Whether it’s a logistics hub, a regional headquarters, or a specialized manufacturing facility, real estate decisions are no longer just about location and square footage. Executives are expected to consider long-term asset value, potential for sale-leaseback arrangements, tax positioning, zoning flexibility, and the ability to collateralize properties for future capital needs.

However, most companies lack in-house capacity to optimize these variables. That’s why more CFOs and COOs are turning to Real Estate Partners—specialized firms that bring together development experience, market data, and financial strategy to make real estate a revenue-enhancing asset instead of a sunk cost.

“When we work with corporate leaders, we’re not just finding them a site,” says Jonathan Lane, Analyst for Real Estate Partners. “We’re helping them build a real estate strategy that mirrors their business trajectory—something that can be monetized or scaled.”

Building the Portfolio: Site Selection with Intent

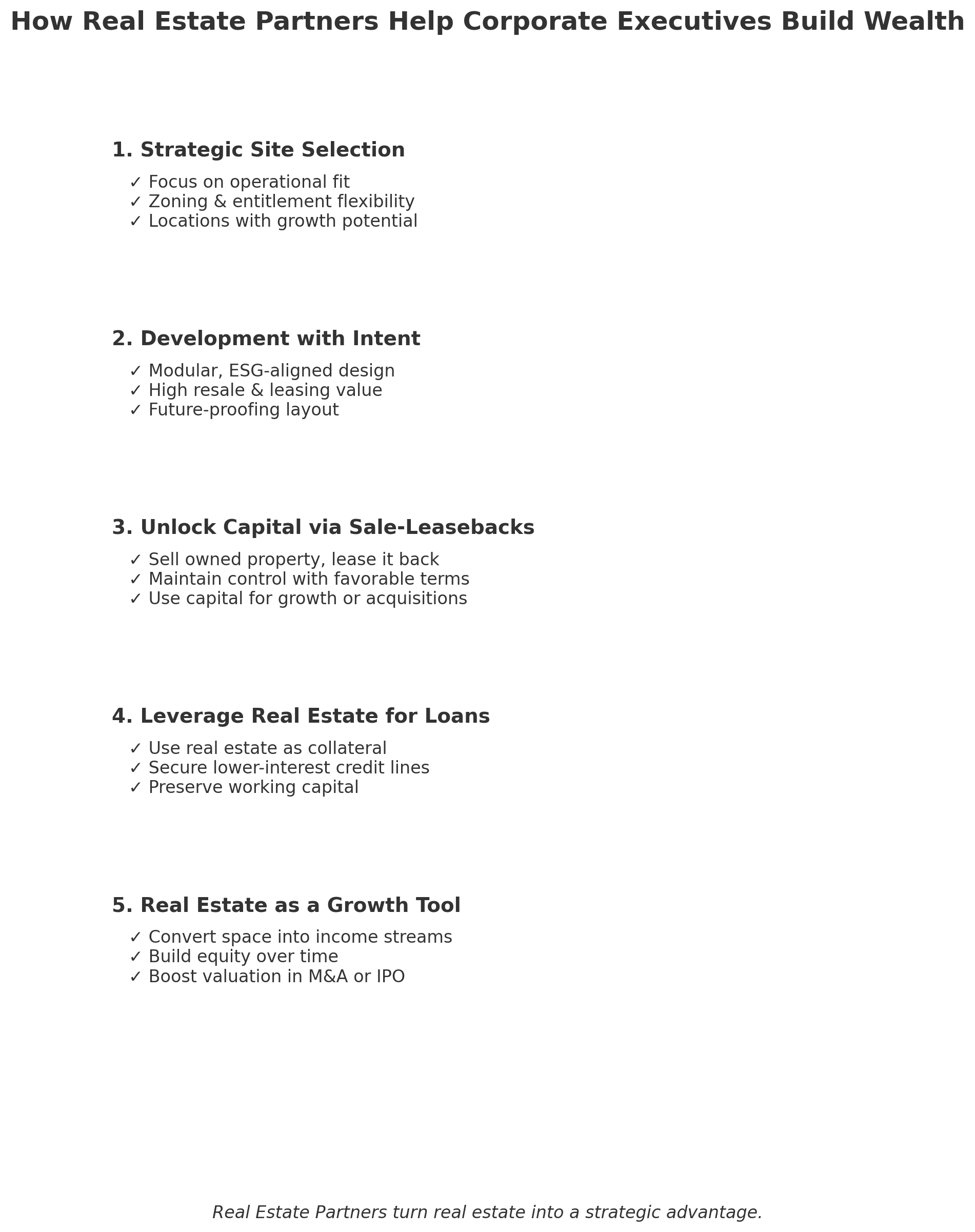

The foundation of a strong corporate real estate portfolio is disciplined site selection. Real Estate Partners approach this through a multifaceted lens:

- Operational fit: Does the location meet workforce, logistics, and access needs?

- Zoning and entitlement flexibility: Is the property adaptable to future business uses?

- Financial upside: Is the location in a market with growth potential and comparables that support future refinancing or sale?

- Leaseback potential: Can the property support a sale-leaseback transaction that unlocks capital on attractive terms?

Instead of defaulting to convenience or tradition, executives guided by real estate professionals choose properties that serve dual purposes—operational efficiency and long-term asset creation.

“We look for locations that are undervalued relative to future infrastructure plans, and where the company can build equity just by being an early mover,” says Lila Cheng, Analyst at Real Estate Partners.

Developing with the End in Mind

Once a site is secured, development is not merely about construction. It’s about future-proofing.

Real Estate Partners coordinate with architects, contractors, and financing teams to ensure that any office building, warehouse, or industrial site aligns with modern standards, ESG requirements, and modularity for evolving use cases. These decisions impact resale value, appraisal outcomes, and even insurance premiums.

Development is tailored to the company's anticipated growth—whether they plan to occupy long-term, lease a portion, or eventually offload the asset. For example, a storage facility can be built with additional loading dock space to accommodate e-commerce growth, while office space can be designed with convertible flex zones that increase its marketability to tenants in the future.

The Sale-Leaseback Advantage

One of the most powerful tools executives gain access to through their Real Estate Partners is the sale-leaseback—a financial strategy where the company sells its owned real estate to an investor but leases it back under favorable terms. This delivers a capital injection while retaining control of the property for operations.

This model appeals especially to asset-light companies or firms looking to boost liquidity without raising debt or diluting equity.

Here's how a Real Estate Partner can maximize this opportunity:

- Valuation expertise: Ensuring the property is developed and appraised for its highest and best use, which can command stronger sale prices.

- Investor access: Tapping into networks of institutional buyers, REITs, or private equity firms who actively pursue corporate-owned real estate.

- Negotiating favorable leases: Locking in long-term control of the space at below-market rates, with built-in flexibility clauses.

“We helped a packaging company unlock $17 million in capital through a sale-leaseback on a facility they thought was just a sunk cost,” explains Jason Riedel, Analyst for Real Estate Partners. “That capital went directly into an acquisition that doubled their output.”

Lending Against Built Assets

A real estate portfolio isn’t just useful for liquidity through sale—it’s also collateral. Properties developed under expert guidance can be pledged to secure lower-cost credit lines or structured loans. For companies with variable revenue cycles, this kind of collateralization can protect working capital while preserving equity.

Real Estate Partners work closely with commercial lenders and institutional banks to structure deals where the company’s portfolio supports strategic borrowing. This is particularly valuable for mid-market firms and family-owned businesses that may lack other forms of leverage but hold significant real estate value.

Case Study: Strategic Growth via Industrial Development

A mid-sized logistics company in Southern California was looking to expand its warehouse capacity. Rather than leasing space at rising market rates, it worked with a Real Estate Partner to identify a tract of land just outside the logistics hub of Ontario, CA.

The Partner helped the company:

- Acquire the land at a favorable price

- Navigate permitting and pre-development

- Design the facility to accommodate both current needs and potential sub-tenant income

- Secure construction financing

- Structure a leaseback with a private equity investor, releasing $25M in working capital while retaining site control

That $25M helped fund two acquisitions and expand the firm’s delivery footprint. Meanwhile, the real estate remained a performing asset on the books.

Future-Proofing Executive Decision-Making

The key benefit to executives? Control, optionality, and growth.

By working with Real Estate Partners, corporate leaders get more than just location advice—they get a framework for building a portfolio that supports the enterprise’s capital strategy. Real estate becomes an active instrument in the CFO’s toolkit, not a fixed overhead line item.

Companies can scale faster, manage risk more effectively, and exit or transition with greater leverage.

Real Estate Partners are reshaping how corporate executives think about property—not as fixed expenses, but as strategic assets. Through disciplined site selection, thoughtful development, and intelligent financial structuring, these partnerships allow companies to build portfolios that generate liquidity, appreciate over time, and offer flexible exit paths through leasebacks or refinancing.

In a world where every asset must justify its place on the balance sheet, real estate is no longer just where business happens—it’s how business grows.